PROP# 1

The ballot will read:

The constitutional amendment authorizing the legislature to provide for the reduction of the amount of a limitation on the total amount of ad valorem taxes that may be imposed for general elementary and secondary public school purposes on the residence homestead of a person who is elderly or disabled to reflect any statutory reduction from the preceding tax year in the maximum compressed rate of the maintenance and operations taxes imposed for those purposes on the homestead.

If Prop# 1 passes, The Texas Constitution will be amended to read:

Article VIII, SECTION 1. Section 1-b, adding Subsection (d-2) to read as follows:

(d-2) Notwithstanding Subsections (d) and (d-1) of this section, the legislature by general law may provide for the reduction of the amount of a limitation provided by Subsection (d) of this section and applicable to a residence homestead for a tax year to reflect any statutory reduction from the preceding tax year in the maximum compressed rate, as defined by general law, or a successor rate of the maintenance and operations taxes imposed for general elementary and secondary public school purposes on the homestead. A general law enacted under this subsection may take into account the difference between the tier one maintenance and operations rate for the 2018 tax year and the maximum compressed rate for the 2019 tax year applicable to a residence homestead and any reductions in subsequent tax years before the tax year in which the general law takes effect in the maximum compressed rate applicable to a residence homestead.

Prop# 1 proposes to provide a reduction of the amount of property taxes for general elementary and secondary public school purposes on the residence homestead of the elderly or disabled.

Let’s review recent history of ad valorem tax exemptions adopted via amendments to the Texas constitution…

2007: exempt all or part of the residence homesteads of certain totally disabled veterans

2011: property tax exemptions for surviving spouse of a “100 percent or totally disabled veteran”

2013: exemption for surviving spouse of a member of the U.S. armed services who is killed in action (KIA).

2015: Removed the date-of-death restriction regarding disabled veterans so that all surviving spouses now inherit the exemption (3800 homesteads qualified for this new exemption that year). For those taxing districts with higher populations of disabled veterans, the state subsidizes these cities with taxes from other districts. And this 2015 homestead exemption is available to all surviving spouses that move to Texas from other states.

2017: exemption from ad valorem taxation of all or part of the market value of the residence homestead of the surviving spouse of a first responder who is killed or fatally injured in the line of duty.” Fatally injured means the responder could die later, as a result of actions taken while performing official on-the-job duties. (There are 17 categories of government personnel that qualify for this tax exemption)

2021: extension of property tax exemptions on public school taxes to a surviving spouse of a qualifying disabled property owner as long as the survivor is 55 years of age or older.

Prop #1 passed unanimously in both the House and the Senate

1) Is it “constitutional”?

(Supports the constitutional republic)

NO

Government favoring one class of citizens over others flies in the face of a republic. Prop# 1 continues to support a special class of property owners over others.

2) Is there a need?

(Do all the People have a need for and benefit from the proposed government intervention?)

NO

While public schools should be abolished all together for doing such a horrible job, forcing a smaller pool of property owners to carry the load does not benefit all property owners.

3) Affordability?

(Can the People afford it? Is the cost equal and uniform?)

NO

The exemption is neither uniform nor affordable. Property taxes are Marxist with the intent to abolish property ownership. To be constitutional, this amendment would abolish all ad valorem property taxes.

==================================

PROP# 2

The ballot will read:

The constitutional amendment increasing the amount of the residence homestead exemption from ad valorem taxation for public school purposes from $25,000 to $40,000.

If Prop# 2 passes the Texas Constitution will be amended…

Article VII, Section 1-b(c):

(c) The amount of $40,000 [$25,000] of the market value of the residence homestead of a married or unmarried adult, including one living alone, is exempt from ad valorem taxation for general elementary and secondary public school purposes….

Enabling legislation; SB1 summary:

The bill provides for the protection of school districts against the resulting loss in local revenue as a result of Prop# 2 by entitling certain districts to additional state aid, if necessary.

Prop# 2 passed unanimously in both the House and Senate.

1) Is it “constitutional”?

(Supports the constitutional republic)

YES

Although taxation on real property of any kind is Marxist, any reduction for all property owners is one step toward a republican form of government.

2) Is there a need?

(Do all the People have a need for and benefit from the proposed government intervention?)

YES except renters

3) Affordability?

(Can the People afford it? Is the cost equal and uniform?)

YES and NO

– YES – All property taxes must be eliminated but, it should be recognized that with this amendment the People will still pay, one way or another, for those certain school districts that require state aid to stay afloat.

– NO – Property tax exemptions on residential property does NOT apply to rental property. Renters pay a higher proportion of ad valorem taxes.

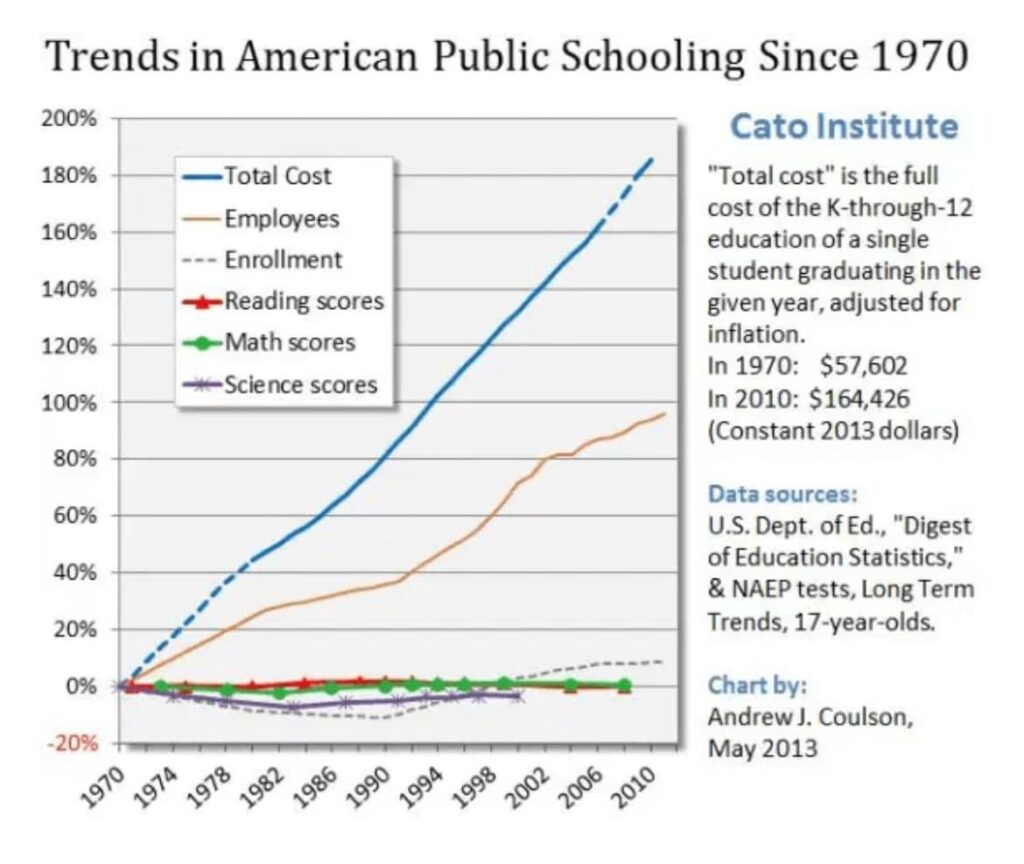

Our state originally offered public education to all Texas children via state revenue received from land owned by the State. As the State added local property taxes to the public school equation we experienced the skyrocketing cost of public education and the deterioration of the quality. Currently we spend more on public education than ever before, with a corresponding decline in scores/aptitude and reading comprehension. Prior to the 1950s the American student ranked 1st in math and science. We’re very close to the bottom now.

THANK YOU for this very important analysis of these amendments. I totally agree that schools should be funded by the Permanent School Fund and NOT taxes on people’s homes. Last year, there was $55.6B in the fund. If there are 1,027 districts, that works out to be about $55M per district. A more equitable distribution might be allocating the funds per student.

Here are some unofficial, pissed-off taxpayer calculations:

$55,624,100,000 in the Permanent School Fund.

There are 5,371,586 students in Texas.

That would be $10,355.25 per student.

There are 6,170 students in Lockhart ISD, where I live.

That would be $63,891,892.50 for the District.

Currently, there is a budget of $68,541,634.

Difference of $4,649,741.50 shortfall could be made up with better management. My daughter worked in purchasing at LISD and saw books being purchased and then warehoused, just because the money had to be spent or lost the next year.

The highest paid administrative office, Superintendent, is $220,000 per year not including benefits like insurance and an expense account. The Supt. serves 6,170 students and 752 staff, or 6,922 people. That works out to $31.78 per person served.

Consider: The governor of Texas makes $153,750 per year to serve 331,400,000 people. Gov. Abbott gets $.00046 per person served.

The rate of LISD students who graduate at mastery of grade level was 4%-5% (2018-19), according to TEA. This is a 95%-96% failure rate. Perhaps the salary of the Supt and other administrators should be tied to successful performance — when kids fall short, so does the paycheck.

Gen. Smedley Butler wrote in 1935, “War is a racket.” Apparently, Gen. Butler never saw the state of public education today, or he might have had a longer book.