November 5th, 2019 all registered voters residing in Texas will have an opportunity to act as citizen legislators and cast a ballot “FOR” or “AGAINST” ten proposed amendments to our Texas Constitution. Ballot wording doesn’t allow space to fully inform a voter on the specific government action. This article will attempt to offer some of that missing information.

In this article, each proposition will be filtered through a three-question evaluation. Those three questions are:

1) Is it “constitutional”? – Does it support our constitutional republic?

2) Is there a need? – Do all the People have a need for and benefit from the proposed government intervention?

And …

3) Affordability? Can the People afford it? Is the cost equal and uniform?

The basis for these 3 questions is explained here:

https://ntcl.org/2013/10/13/all-laws-must-pass-the-constitutional-test/

Prop# 1

“The constitutional amendment permitting a person to hold more than one office as a municipal judge at the same time.“

The relative action we’re addressing here is appointed v elected municipal judges. Prop#1 would amend the Texas Constitution to allow a municipal judge to serve in more than one municipality at the same time regardless of whether elected or appointed to each office.

If this amendment passes, Section 574.001(b), Government Code, is amended to read as follows:

(b) A person may hold the office of municipal judge for more than one municipality at the same time [if each office is filled by appointment].

1) Is it “constitutional”?

(Supports our constitutional republic)

Yes. Increasing the pool of candidates for the People to elect as municipal judge can’t be wrong in a republic.

2) Is there a need?

(Do all the People have a need for and benefit from the proposed government intervention?)

Yes, specifically in rural, sparsely populated municipalities with fewer or no qualified residents.

3) Affordability?

(Can the People afford it? Is the cost equal and uniform?)

Yes. Each municipality is still able to choose whether to elect or appoint their municipal judge(s), so the cost of elections would be the only fiscal note of consideration.

Both the Proposition and the enabling legislation passed unanimously in each chamber: HJR 72 / HB 1717

Prop#2 “The constitutional amendment providing for the issuance of additional general obligation bonds by the Texas Water Development Board in an amount not to exceed $200 million to provide financial assistance for the development of certain projects in economically distressed areas.”

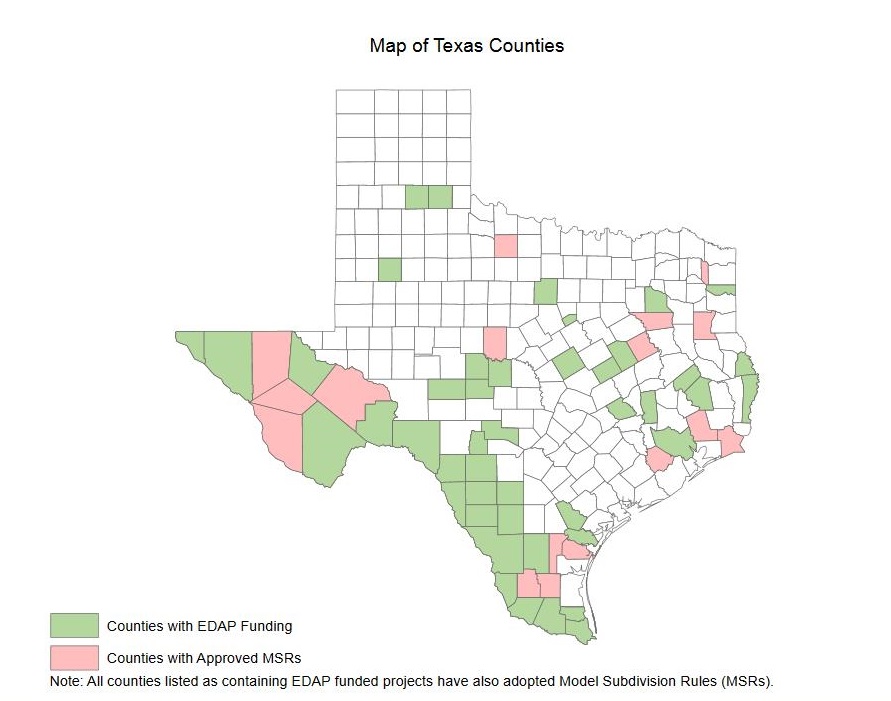

Here’s a 2019 map of the counties involved in the “economically distressed area program” – or “EDAP” for short. The green counties are receiving EDAP funding. The pink counties have filed for and qualify for EDAP funding.

BACKGROUND: Since the 1950s, people have been settling on property outside of cities, living without basic infrastructure, called “colonias”, which means “neighborhood” in Spanish. These are predominantly unincorporated areas. Most of these more than 2,000 “colonia” settlements are without water and sewage systems, electricity, and paved roads. County and state regulations did not require developers to provide basic services if the land didn’t exceed a certain number of lots.

In the early 1990s, the U.S. Department of Housing and Urban Development and the Department of Agriculture officially recognized colonias as neighborhoods within 150 miles of the border that lack some basic utilities. The National Affordable Housing Act of 1990 required that all the border states set aside a percentage of Community Development Block Grants for colonias. So here we are, 30 years later and the colonias continue to grow and taxpayers are asked to continue funding this increase in colonias.

In 1989 the Texas Legislature established the Economically Distressed Areas Program (EDAP) under the control of the Texas Water Development Board (TWDB). Texas EDAP provides financial assistance for projects to develop water and wastewater services in economically distressed areas where these services or facilities are inadequate to meet minimum state standards. An economically distressed area is defined as a political subdivision in which the median income level is less than 75 percent of the state’s median income level. In 2017 the Texas state median income was $59K. A political subdivision with median income under $44K qualifies for EDAP funding.

EDAP initially was funded through $250.0 million in GO bonds approved by Texas voters in 1989. Then in 2007, voters approved another $250.0 million in GO bonds. Plus the TWDB has utilized an additional $199.0 million from non-EDAP programs, out of the state’s general revenue, and the feds have funded EDAP communities.

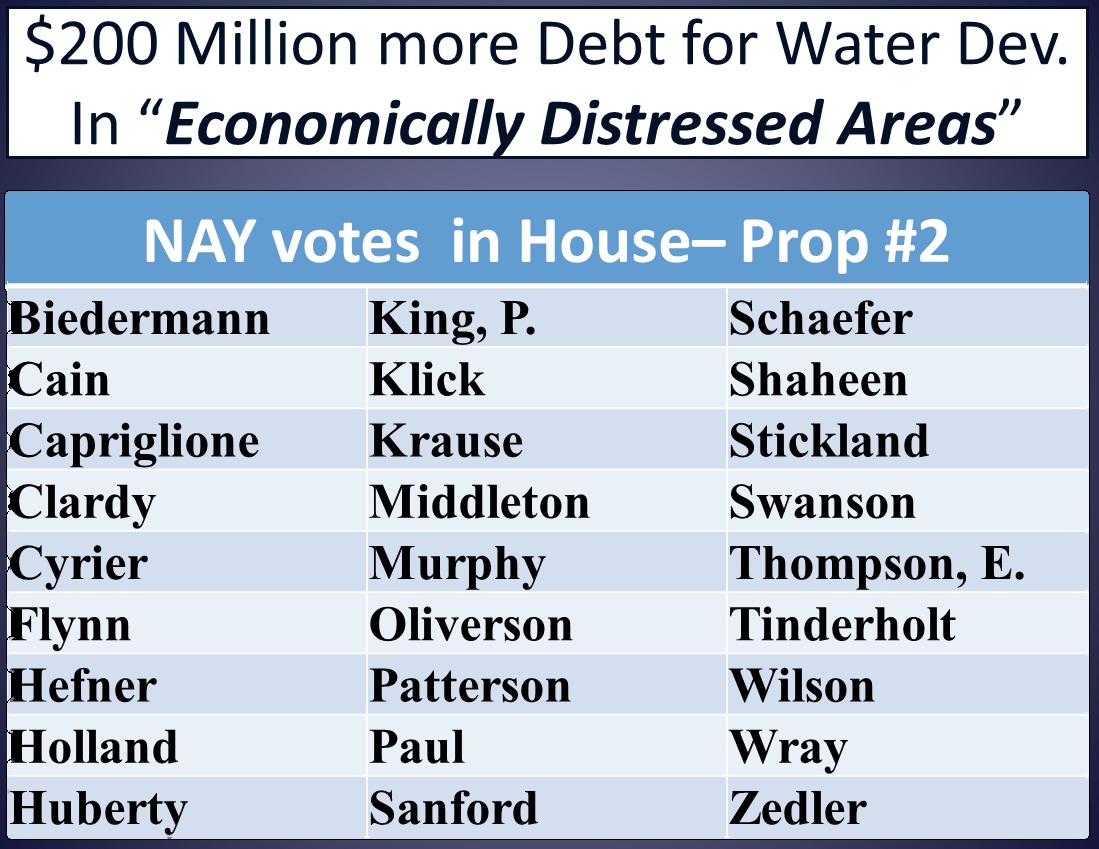

Prop#2 (SJR79) received a fair amount of resistance in both the House and the Senate. Here are the 27 Nay votes in the House – all Republicans…

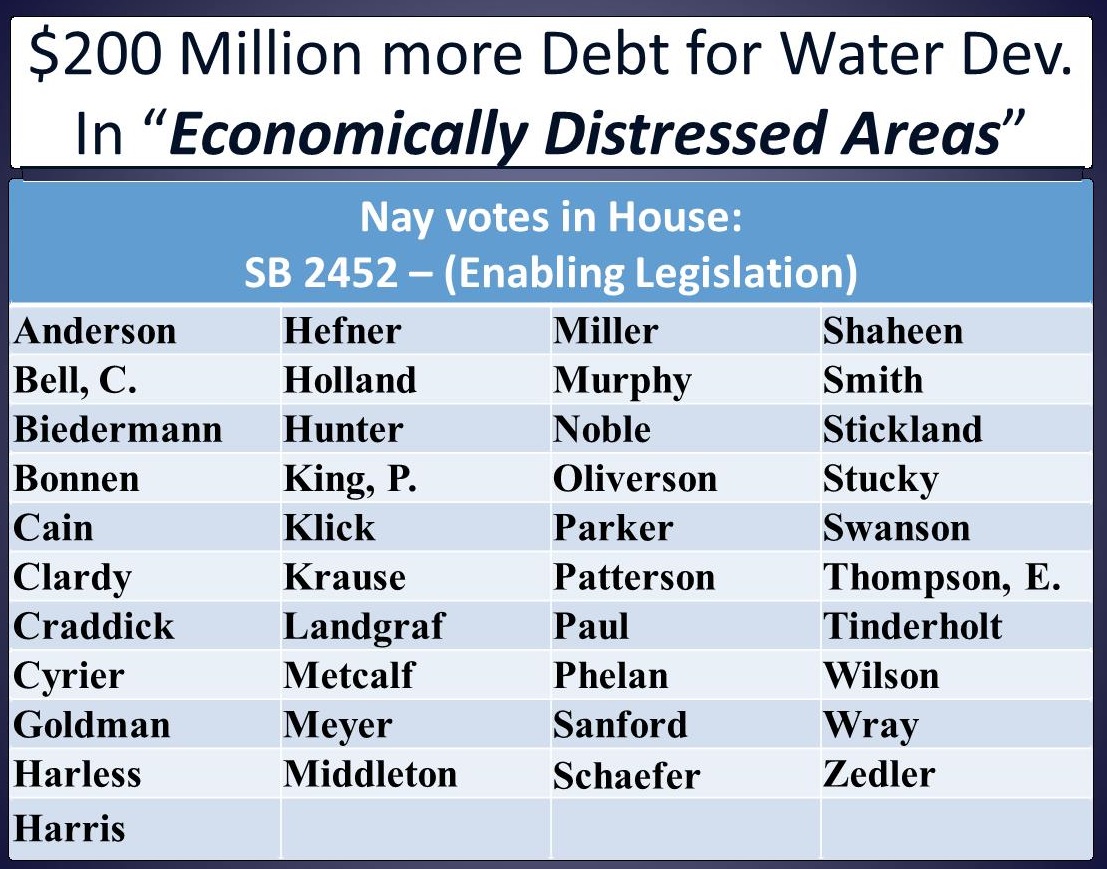

And for the enabling legislation, (SB 2452), there were 41 Nay votes in the House, as shown here, again all Republicans…

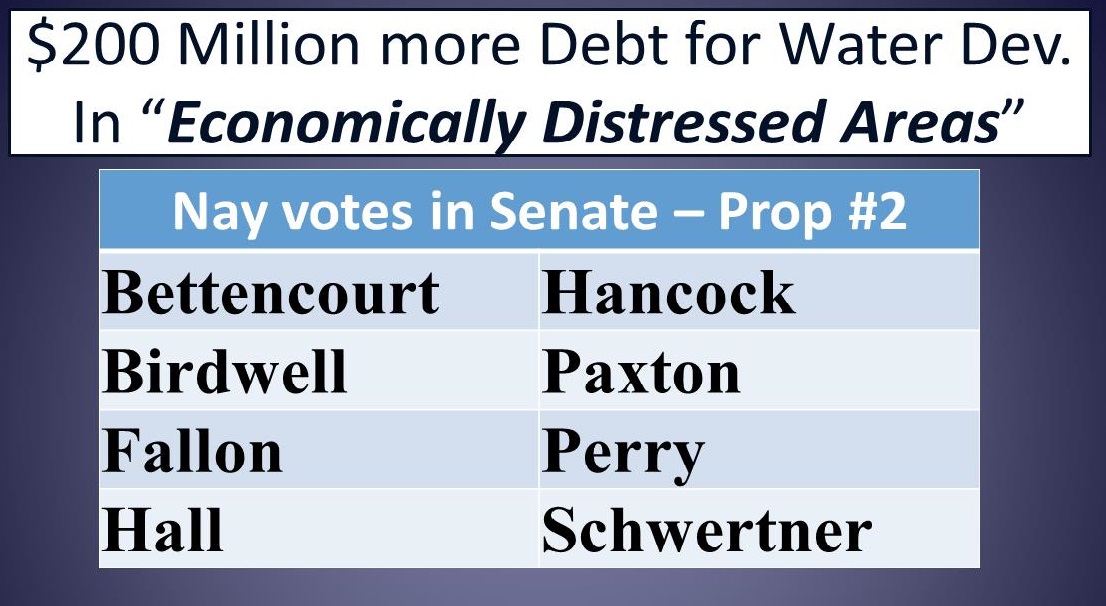

In the Senate, here are the 8 Nay votes on Prop #2 – all Republicans…

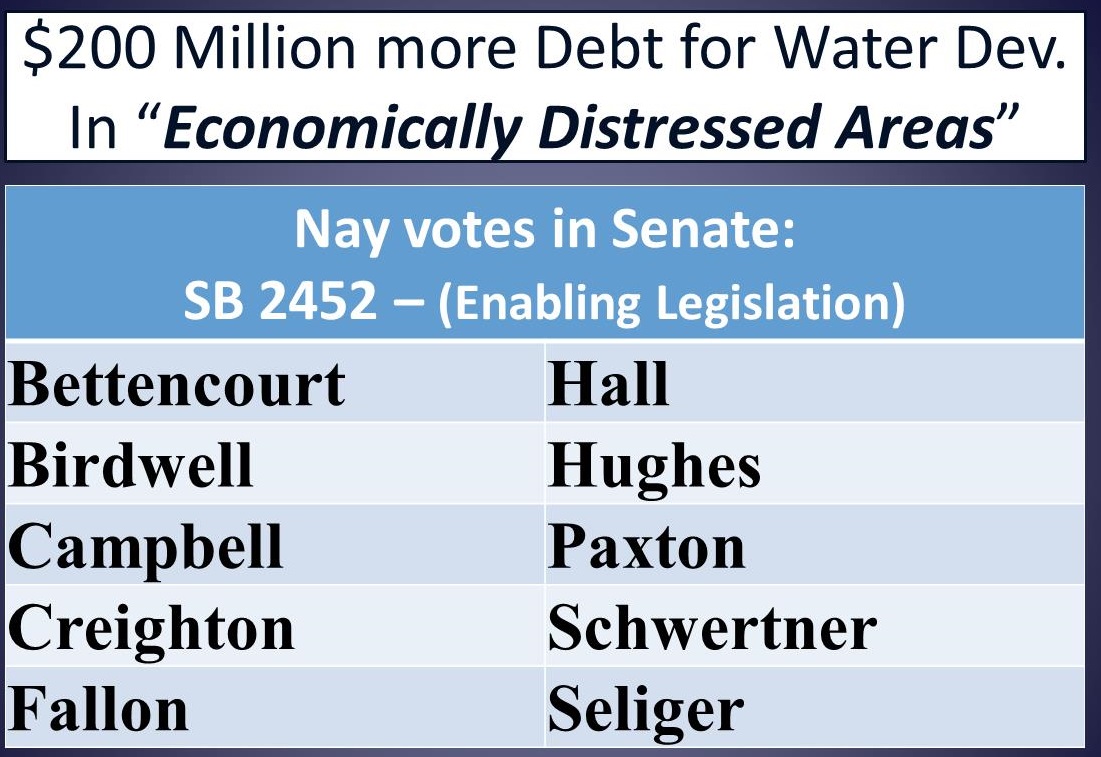

And the 10 Senate Nay votes on the enabling legislation, all Republicans…

1) Is it “constitutional”?

No. Taking money from Texas taxpayers to provide entitlements to others is communist and antithetical to a republic.

2) Is there a need?

No, only those who made a decision to settle on a plot of land that has no sanitation services are in need. Other communities tax their residents to pay for these same services. Continuing to tax the incomes of all Texans to promote dependent lifestyles for others is counter-productive to liberty.

3) Affordability?

No. Any increase in taxes is unaffordable, and some of these bonds don’t have to be paid back, leaving Texas taxpayers holding the debt.

Prop #3

“The constitutional amendment authorizing the legislature to provide for a temporary local option exemption from ad valorem taxation of a portion of the appraised value of certain property damaged by a disaster.“

If this proposition passes, a political subdivision may take advantage of this process, and it must do so within 60 days of the Governor’s Declaration of an area as a disaster area. Then, there are time requirements for the property owner to apply for the exemption, depending on certain property criteria.

The Legislature prescribes the method of determining the amount and duration of the exemption, as well as any additional eligibility requirements (see HB492)

The County appraiser will still assess the level of damage (Level I, II, III, or IV), and be in charge of accepting applications from qualifying property owners within applicable taxing units.

HB 492, the enabling legislation amends the Texas Tax Code to provide for the property exemption levels. If this amendment passes, those levels will be…

Level I = 15%-30% damage [qualifies for a 15% exemption]

Level II = 30% – 60% damage with waterline less than 18 inches above the floor, and no structural damage to the dwelling. [for a 30% exemption]

Level III = At least 60% damage but not a total loss, with structural damage, or waterline more than 18 inches above the floor [for a 60% exemption]

Level IV = a total loss, meaning the repair of property is not feasible. [100% exemption]

Generally speaking, this temporary tax exemption from ad valorem taxes for a qualifying structure would last 12 months or less, depending upon the effective date of the exemption.

This proposed amendment and its enabling legislation were approved without any “nay” votes in either chamber.

1) Is it “constitutional”?

Property taxes are antithetical to our republic, but any move toward reduction or elimination does support a constitutional republic.

2) Is there a need?

Unless the cost of government services & expenses will be eliminated proportionate to percentage of property tax decrease, property owners not receiving an exemption within the same taxing district will absorb the cost to make up the lost revenue to the taxing unit.

3) Affordability?

No the cost is not equal unless every dwelling in the specific taxing district is affected.

Prop#4

“The constitutional amendment prohibiting the imposition of an individual income tax, including a tax on an individual’s share of partnership and unincorporated association income.”

Currently the Texas Constitution allows the Legislature to place a question on a statewide ballot, asking for voter approval (or disproval) of a state tax on incomes of certain individuals. Prop#4 would repeal that section of the Constitution, along with 2 pages of other text that addresses the power to impose a progressive income tax consistent with federal law, as well as an ad valorem, or direct property tax for maintenance and operation of local public schools.

In summary, if Prop #4 passes, all of Section 24 of the Texas Constitution is repealed, and replaced with…

“The legislature may not impose a tax on the net incomes of individuals, including an individual’s share of partnership and unincorporated association income.”

Prop #4 was passed with all the Republicans voting “FOR”

In the House it passed: 100 – 42

(20 Democrats voted “FOR” Prop#4)

In the Senate: 22-9

(3 Democrats voting “FOR” Prop#4)

This amendment did not require enabling legislation to change the tax code.

1) Is it “constitutional”?

Yes. Income taxes are antithetical to liberty and individual freedom, especially the Marxist progressive income tax. Prohibiting such tax supports a republic. However, the legislature should have written the amendment to read “shall not impose” instead of “may not impose”.

2) Is there a need?

Yes. Most if not all Texans can appreciate less legalized government theft.

3) Affordability?

Yes. Absence of state income taxes is equal for every individual.

Prop#5

“The constitutional amendment dedicating the revenue received from the existing state sales and use taxes that are imposed on sporting goods to the Texas Parks and Wildlife Department and the Texas Historical Commission to protect Texas’ natural areas, water quality, and history by acquiring, managing, and improving state and local parks and historic sites while not increasing the rate of the state sales and use taxes.“

Currently, the Texas Tax Code requires 94 percent of the sporting goods tax proceeds be credited to the Texas Parks and Wildlife Department (TPWD), while 6 percent is credited to the Texas Historical Commission (THC). Reportedly, not all of the generated taxes have been appropriated this way.

Prop #5 would amend the Texas Constitution to automatically appropriate these taxes collected, beginning in September 2021.

The enabling legislation, would allow sporting goods sales tax to be used for new additional purposes, such as….

Parks & Wildlife’s 94% share:

• Debt service payments on park-related bonds

• benefit related costs of TPWD employees

• certain benefit programs under the Employees Retirement System of Texas

Of the 6% that goes to the Historical Commission…

The amendment would make the separate “historic site account” a “dedicated” account within the general revenue account.

Prop#5 allows the Legislature to reduce the amounts allocated by 50% or less with a 2/3 vote in each chamber.

There was one lone “nay” vote on Prop #5, that of Rep Jonathan Stickland of Bedford.

Not a single nay vote on the enabling legislation in either chamber.

1) Is it “constitutional”?

Yes, many of our state parks are located on land that is uninhabitable, such as flood plains, or areas acquired through eminent domain to create water reservoirs. Such areas serve millions of Texans with not only potable water but recreation, hunting, and natural habit for a variety of wildlife. Such activities are not possible for most municipalities to create and sustain, thus the state acts in this area, and applies certain sales tax collected from goods related to sports and outdoors. Also of great importance is preservation of our state historic sites and markers.

2) Is there a need?

Yes. For the same reasons that it is constitutional

3) Affordability?

Yes, since we’re only talking about sales tax, and a small amount of lost revenue to the state’s General Revenue fund, the current benefits outweigh lost revenue. However it should be noted that this proposition will put it in the constitution that the legislature (by a 2/3 vote) may reduce these amounts by 50% or less.

Prop#6 “The constitutional amendment authorizing the legislature to increase by $3 billion the maximum bond amount authorized for the Cancer Prevention and Research Institute of Texas.”

BACKGROUND: In 2007, voters approved a Constitution Amendment, creating the Cancer Prevention and Research Institute of Texas and with that, we approved issuance of state debt to the tune of $3 Billion total, with a max of $300 Million issued each year. Here we are 12 years later and the Legislature wants to double that debt to $6 Billion. We voters must make the final decision.

The Texas Health & Safety Code explains the purpose of CPRIT… Sec. 102.002. PURPOSES. The Cancer Prevention and Research Institute of Texas is established to: Create and expedite Innovation of cancer research, enhancing potential for medical/scientific breakthrough in prevention and cures for cancer, and to attract, create, or expand research capabilities of public or private institutions of higher education and other public or private entities that will promote a substantial increase in cancer research and in the creation of high-quality new jobs in this state.

CPRIT is subject to the Texas Sunset Act and is set to expire Sept 2023.

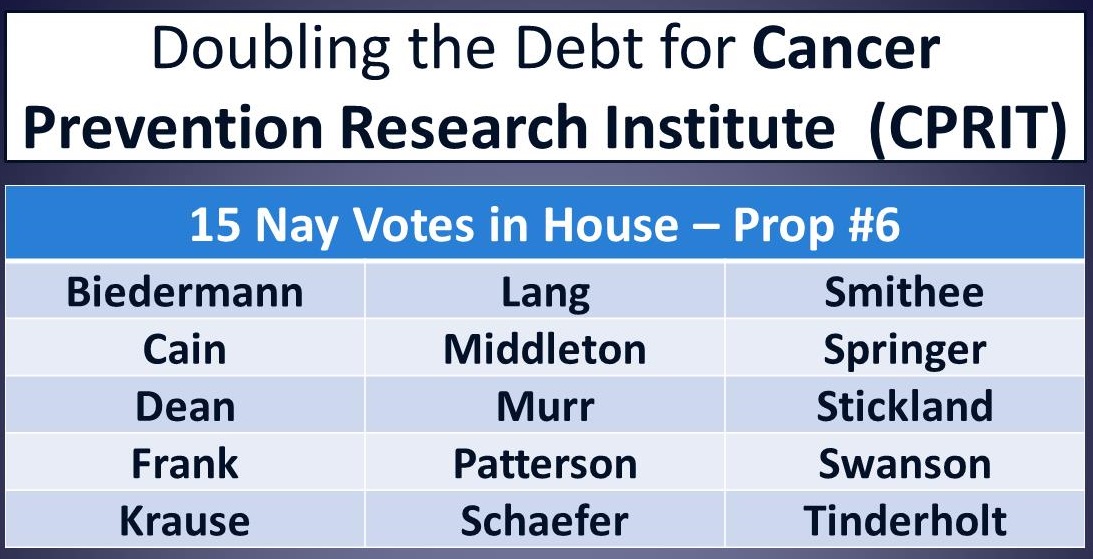

Prop #6 passed unanimously, 31-0 in the Senate. But in the House it passed 130-15. The 15 Nay votes in the House are listed here…

Is it “constitutional”?

Yes if you believe that taxpayers should fund research through more public debt, and support government choosing the winners and losers.

No if you believe that research should be funded through the private free market and university endowments.

2) Is there a need?

(Do all the People have a need for and benefit from the proposed government intervention?)

No. CPRIT does not fund many holistic, non-pharmaceutical, non-surgical cancer cures that have shown great success rates, such as the Alternative Therapies used at the Burzynski Clinic in Houston, which for 40 years has shown success through targeted immunotherapy. As a matter of fact the Texas Medical Board has sued Burzynski half a dozen times in an effort to shut him down. How many other free-market research clinics have been shunted to protect the government-favored Big Pharma research?

3) Affordability?

(Can the People afford it? Is the cost equal and uniform?)

No. Funding of CPRIT is based on Texas taxpayers funding additional debt for government to choose winners and losers. According to the Legislative Budget Board, the Amendment would have a two year estimated cost of about $12.5 million in general revenue related funds for debt service payments through fiscal 2020-21.

Prop#7 “The constitutional amendment allowing increased distributions to the available school fund.“

The Permanent School Fund (PSF) is a perpetual endowment for the public schools of this state, and was set up in our 1876 TX Constitution. It consists of state owned assets in the form of land, minerals, and investments from the sale of these items.

Annually, proceeds are moved from the PSF to the Available School Fund (ASF) to be appropriated by the Legislature for public education. The ASF is also funded through a variety of sales taxes.

This proposed amendment deals with increasing the funding of the annual ASF, and it expands who can direct those revenues. Through the enabling legislation, HB 4611, Prop#7 will…

1) Remove the current prohibition of the State Board of Education, and specifically name the SBOE with the authority to make direct distributions to the ASF, along with other entities

2) Authorize each approved entity to make a direct distribution to ASF up to $600 Million annually .

3) It will increase the previous cap on each distribution to $600 Million, from the previous cap of $300 Million.

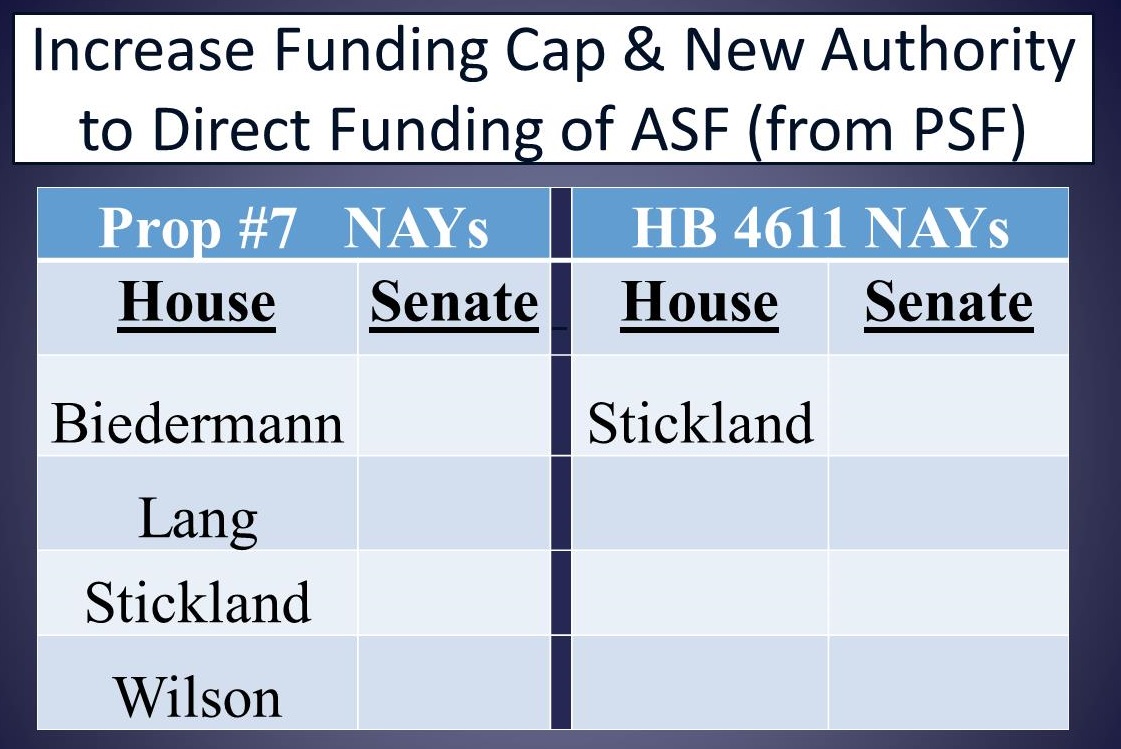

Prop#7 and the enabling legislation passed 31-0 in the Senate. There were a few nay votes in the House on both Prop#7 and the enabling legislation…

1) Is it “constitutional”?

Yes. The 1876 TX Constitution set up a perpetual public school fund, to which up to one-fourth of the state’s general revenue was set aside. The fund later became known as the Permanent School Fund. A state school property tax was added 100 years later in 1883, along with the local school property tax. The PSF is managed by a board appointed by the General Land Commissioner. The fund is worth $44 Billion today. Many could support this amendment if the State would stop accepting the unconstitutional federal money with their Marxist programs that have ruined our schools. But since our government schools do such a horrible job, and local school taxes are way out of control, many don’t support giving the government schools any more money until they return to good academic immersion.

2) Is there a need?

NO. Our schools, just like all departments of today’s government, don’t have a funding problem. They have a spending problem. If the state would eliminate the addiction to federal education funds and their required Marxist programs, one could get excited about funding our public schools again.

3) Affordability?

Yes, this doesn’t affect property taxes, just the balance held in the Permanent School Fund. Now, if the PSF runs dry, the Feds will own our public schools

Prop#8 “The constitutional amendment providing for the creation of the flood infrastructure fund to assist in the financing of drainage, flood mitigation, and flood control projects.”

BACKGROUND: Federal funds are available for flood projects after disastrous events, but counties and cities may not be able to put up the matching funds necessary to access that money. Because of that, federal money has been left on the table.

The Flood Infrastructure Fund, or FIF, that will be created by Prop #8 will take money from the Texas Economic Stabilization Fund (ESF), aka the “Rainy Day Fund”. The ESF was created in 1988, and is funded primarily with taxes on oil and gas production.

The newly created FIF would provide loans at or below market rates to help local governments meet matching fund needs and assist with basic flood project planning, grant applications, and the engineering of structural and nonstructural flood mitigation projects. The FIF would be a special fund in the state treasury outside the general revenue fund. As provided by the enabling legislation, the fund will be administered and controlled by the Texas Water Development Board. The three (3) member Water Development Board is appointed by the Governor and was created in 1957.

SB7, the enabling legislation for Prop#8, would appropriate $3.26 Billion from the ESF to the FIF and also allocate the first $3.05 million of the maintenance taxes collected from insurance companies in Texas, and deposit to this new FIF.

Prop#8 passed in both chambers without a single Nay vote. There was one Nay vote on the enabling legislation, that of Rep. Jonathan Stickland.

1) Is it “constitutional”?

YES. Government is instituted to protect individual property

2) Is there a need?

YES. Since flood waters don’t recognize the geographical boundaries of political subdivisions, the State assists in the coordination of efforts to mitigate flooding through expensive and often massive infrastructure projects. The TWDB is the central agency for the planning and funding of projects. Reportedly, federal matching money is left on the table due to smaller communities’ inability to meet certain criteria. However, one should question the authority of the Feds to fund local infrastructure with their strings attached.

3) Affordability?

YES. Prop #8 will offer low or no interest loans, through the FIF. The TWDB will offer assistance with federal grants. SB7, the enabling legislation, will not only address flood mitigation but also water retention for areas that deal with drought. According to the Legislative Budget Board, SB7 would have a negative impact of $5.8 million to general revenue related funds through fiscal 2020-21. The bill also would appropriate $3.26 billion from the Economic Stabilization Fund in fiscal 2020.

Prop#9

“The constitutional amendment authorizing the legislature to exempt from ad valorem taxation precious metal held in a precious metal depository located in this state.“

BACKGROUND: In 2015, a bill (HB 483-84R) by Rep. Capriglione, was passed, creating the Texas Bullion Depository. The Depository is owned and operated by a private company, Lone Star Tangible Assets, located in Leander, TX. “Bullion” is defined as “precious metals that are formed into uniform shapes and quantities such as ingots, bars, or plates, with uniform content and purity, as are suitable for or customarily used in the purchase, sale, storage, transfer, and delivery of bulk or wholesale transactions in precious metals.” Also included in this definition is “specie”, defined as “a precious metal stamped into coins of uniform shape, size, design, content, and purity, suitable for or customarily used as currency, as a medium of exchange.”

Tex. Const. Art. 8, sec. 1 requires all real and tangible personal property in the state to be taxed in proportion to its value unless exempt as required or permitted by the Constitution. Prop #9 would amend the Constitution by adding this section to the end of Article 8 in the Constitution…

Sec. 1-p. The legislature by general law may exempt from ad valorem taxation precious metal held in a precious metal depository located in this state. The legislature by general law may define “precious metal” and “precious metal depository” for purposes of this section.

Gold and silver have always been considered legal tender. The IRS doesn’t tax possession of legal tender. Texas shouldn’t either.

While this amendment has the look and feel of protection of individual assets, it has details that could harm individuals.

Note that the amendment states: “The legislature by general law may exempt from ad valorem taxation…”, not “shall” exempt, thus opening the door to future taxation of precious metal.

Also note that the legislature may define “precious metal” and “precious metal depository”, and they did! The enabling legislation (HB 2859) that becomes law if Prop#9 passes defines these terms:

“Precious metal“ = a metal, including gold, silver, platinum, palladium, and rhodium, that bears a high value-to-weight ratio relative to common industrial metals and customarily is formed into bullion or specie. “Specie” means a precious metal stamped into coins of uniform shape, size, design, content, and purity, suitable for or customarily used as currency, as a medium of exchange, or as the medium for purchase, sale, storage, transfer, or delivery of precious metals in retail or wholesale transactions.

“Precious metal depository“ = a depository that is primarily engaged in the business of providing precious metal storage to the general public and maintains sufficient insurance to cover precious metal deposited in the depository.

Since these definitions are in statute, future legislators can alter these definitions.

What about the gold and silver many Texans hold in their physical possession on their private property or in a safe deposit box not defined as a precious metal depository by the Legislature? Will the government attempt to criminalize private ownership of gold again like they did in 1933 with the Executive Order from Pres Roosevelt, and again forbid the possession of monetary gold by any individual, partnership, association or corporation?

The 1933 order was justified on the grounds that hard times had caused “hoarding” of gold, stalling economic growth and making the depression worse. People were given 3 weeks to turn in their gold, otherwise pay a fine that’s equivalent to $250K today and/or go to jail for 10 years for 1 ounce of gold – which happened to be the minimum punishment for bank robbery at the time. If you robbed a bank you could get 10 years, and failure to turn in your gold could get you 10 years.

Will we be granting government power to repeat another 1933 grand heist of personal property by voting “for” Prop #9?

Advocates of Prop 9 claim this amendment will increase chances that the Texas depository could join COMEX, a division of the New York Mercantile Exchange that trades futures in metals such as gold, silver, platinum, palladium, and rhodium. That’s all good and fine. The problem though is the enabling legislation, HB 2859, states that a person must “apply” for the exemption with their appraisal district. In other words, persons must register their possession of precious metals with the government. What could go wrong there?

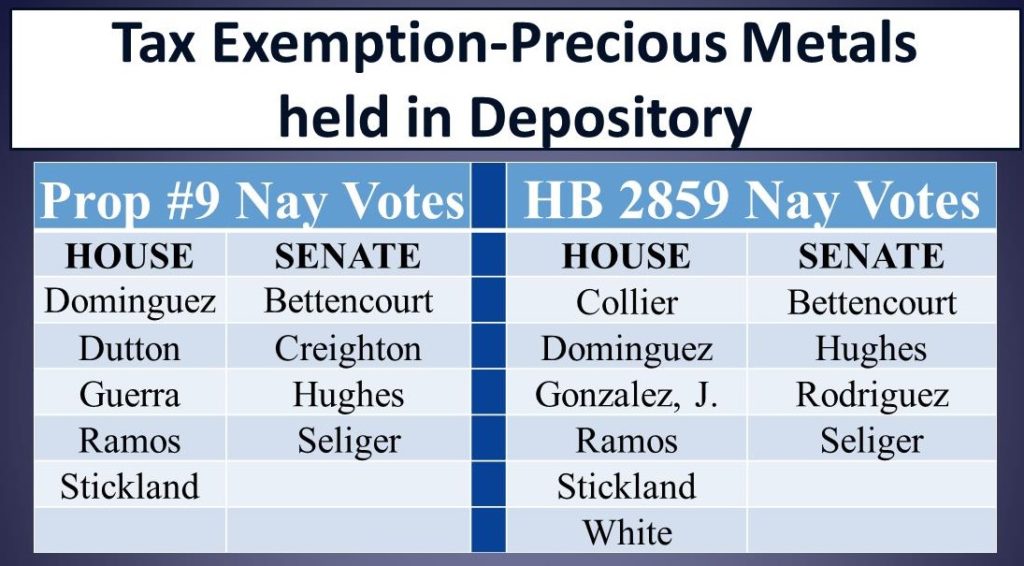

Prop #9 passed in the House 140 – 5

In the Senate, it passed 27 – 4…

1) Is it “constitutional”?

YES. Precious metals have historically been the most popular form of legal tender and mere possession of legal tender is not taxable

2) Is there a need?

NO. Bullion and precious metals are not currently taxable. Where is the threat that it will be in the future, or is this amendment opening that door?

3) Affordability?

If the state ever passes law that precious metals not held in an “approved” state bullion depository shall be taxed, then NO, Prop #9 is not affordable nor just.

Prop#10

“The constitutional amendment to allow the transfer of a law enforcement animal to a qualified caretaker in certain circumstances.”

This is the new proposed language in the Texas Constitution:

Article 3,

Sec. 52l. The legislature may authorize a state agency or a county, a municipality, or other political subdivision to transfer a law enforcement dog, horse, or other animal to the animal’s handler or another qualified caretaker for no consideration on the animal’s retirement or at another time if the transfer is in the animal’s best interest.

Texas law classifies domestic animals as personal property and classifies these animals as salvage or surplus property and generally anticipates that a county will auction off its salvage or surplus property and receive a fee.

Prop #10 would permit the transfer of a law enforcement animal to the animal’s handler or other qualified caretaker for no consideration on the animal’s retirement or other time. The head of a law enforcement agency makes the final determination of the caretaker for the animal’s retirement.

Both the Proposed Amendment and the enabling legislation (SB 2100) passed unanimously in both chambers.

The ENABLING LEGISLATION – SB 2100 – was written so that it was not dependent on voter approval of the corresponding Constitution Amendment. Hence the Texas statutes have already been amended and are current law. Meaning – this is not necessary as a Constitution Amendment. Even if the constitution amendment fails to pass in Nov, which it won’t, the statutes have already set the legislative intent in motion.

1) Is it “constitutional”?

Yes. A law enforcement animal is the property of the government, and upon retirement deserves humane treatment, however this is not required as a constitution amendment.

2) Is there a need?

People in general don’t benefit from this amendment but the animal and his trainer certainly do. The enabling legislation is already effective, and this amendment is not necessary so there’s really not a need to add pages to the 2nd longest state constitution.

3) Affordability?

Yes. There is no cost to government, only to the caretaker. The enabling legislation puts the monetary burden to care for these animals on the assuming caretaker.